Transportation and Fulfillment Solutions to Avoid Inventory Glut

How supply chain strategies can help to avoid inventory glut

Major retailers have been unable to avoid inventory glut as consumer behavior has shifted from the pandemic. Earnings from retailers are significantly down this year as consumers pare back spending on goods. Port volumes and freight rates have been on the rise, echoing the effects of shifting demand. Goods are being brought inland from ocean containers and unloaded into distribution centers – where they remain at a standstill.

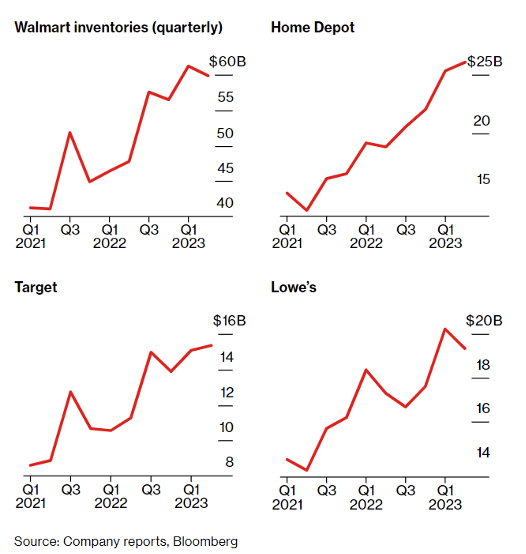

Among the retail giants feeling the effect are Walmart, Target, Home Depot, Lowe’s, and Kohl’s. These companies made big earnings during 2020 and 2021, when consumer spending was at an all-time high on home improvement, home goods, food, and home essentials. Walmart saw inventory levels jump by almost one-third in the first quarter of 2022 and canceled billions of dollars in orders. As the second quarter arrived, the retailer cut the number of shipping containers in its system in half to match demand. Tackling inventory bloat comes at a big cost as earnings fall below analyst estimates. Retailers are now moving aggressively to reduce the supply of discretionary goods.

Trucking industry leaders have reported a mixed demand for services while retail inventory continues to pile. Staffing needs have begun to halt with many major carriers, who were reporting job shortages just a few months ago. Growth opportunities or economic conditions may play out different than expected, but the high demand of the past few years seems to be normalizing. Some companies are dealing with over-inventory situations but there are still others that continue to struggle to stock shelves.

The bust-boom-bust cycle of the last two years has put the retail industry back into the consumers’ hands

Throughout 2020 and 2021, consumers spent their money on goods when many services were shut down such as airlines, lodging, music and sports venues, and more. As these offerings reopened, consumer spending on services rose this year to account for 62% of total consumer spending. However, that fact that spending behavior during the pandemic shifted many consumers to buy online is not to be ignored.

Ecommerce sales are predicted to reach $1.07 trillion in 2022, a milestone that was originally predicted for 2025. Analysts further predict that the share of online retail sales will be 22.1%, an increase from 20.8% in 2021 and 15.2% in 2019. The report from FTI Consulting further predicts ecommerce sales to exceed $2 trillion by 2030 and comprise 31% of the market.

The rocket-like growth of ecommerce is expected to moderate because the public is no longer shopping from home out of necessity. However according to a recent report, convenience has become the second most important factor for brand loyalty. Customers want to purchase products how and when they want and if an item is out of stock, one-third of US consumers will switch retailers while close to 40% will switch brands or products altogether. People no longer buy from a brand simply because they have before, they are looking for the most convenient shopping experience, or the fastest shipping and delivery.

Implementing an agile inventory management strategy to boost the customer experience

The flexibility that omnichannel distribution allows customers is a huge contributor to the satisfaction of their shopping experience. Providing a more convenient experience for customers can come from merging digital and physical experiences when it comes to fulfillment.

An omnichannel distribution strategy is where retail, wholesale, and ecommerce channels merge together, offering a seamless customer experience across multiple channels. Physical stores and online stores are integrated, customers can buy online, pick up in store (BOPIS), reserve online, pick up in store (ROPIS) and curbside pickup. Customers have become accustomed to choosing when, where, and how their orders are fulfilled, as well as comparing across different sales channels for the best price.

What is the difference between omnichannel and ecommerce?

The last two years has certainly forced retail to mobilize and digitize quickly, however there has been a split across traditional brick and mortar and online services. In 2021, brick and mortar sales grew faster than ecommerce as in-person shopping made a comeback. For businesses to remain successful in today’s retail environment they must offer a unified and consistent experience regardless of location and sales channel.

Disrupting the status quo with technology investments

As the ripple effect of the pandemic is felt across the global supply chain, sustained retail change can make or break the customer experience. The customer is king and the factors driving brand loyalty have changed massively. Many retailers are hindered from being able to provide exceptional customer experiences because of legacy systems, poor technology integrations, and lack of visibility. Studies have shown that 44% of retailers are concerned with how lack of real-time data can lead to decisions based on outdated information.

Unifying data from all channels whether it is point-of-sale, ecommerce, ERP, or other systems, will provide more opportunities for success. A seamless retail experience must include employees, suppliers, and customers. All of these interact differently with data and will also require a different software architecture paradigm approach. With even driven architecture (EDA) every retail transaction that takes place is recorded. These events can be used to improve stores, IoT applications, ecommerce platforms, warehouses, HQ, etc. Event-driven architecture unifies physical and digital operations, which will offer a real-time 360-degree view of customers, inventory, and the supply chain.

Latest news on global affairs

This month, congestion at ports across Europe has been steadily increasing and is now at critical levels. Record low water levels along Germany’s Rhine river have been impeding shipping this summer. Weeks of high temperatures and little rainfall has drained the levels in the river, further pushing up freight costs. The disruption has reached such a level that it could knock half a percentage point off economic growth in Europe’s biggest economy this year.

The loading of barges has been reduced by three quarters to avoid vessels running aground and causing more traffic delays. Shipping on the Rhine has reportedly doubled in the last 50 years and the boom in international trade over the past 20 years has increased inland waterway transportation exponentially. Germany currently depends on the river for 80% of its water freight and shipping upwards of 300 million tons of goods. Germany is the third-biggest exporter in the world behind China and the United States. The German economy has been exposed by a string of global events in the past few years, including this recent issue on the Rhine. Germany is a top exporter for vehicles and car parts, machinery, pharmaceuticals, industrial oils, and alcohol.

China is also suffering from record-breaking drought, including the Yangtze river. Parts of the waterway have dried up and are affecting hydropower, putting a stop to shipping, and forcing many major companies to halt operations. Toyota, Foxconn, and Tesla have reportedly temporarily suspended operations at some plants. The Yangtze is the world’s third largest river and is the most vital waterway to China’s economy.

End-to-end supply chain management with a trusted partner

Global disruptions like that on the Rhine can take weeks or even months to trickle down to United States’ soil. Oftentimes there are warning signs coming down the line, but these can be easily overlooked when caught up in day-to-day operations. One-size-fits-all solutions will not necessarily work for every shipper. Partnering with experienced port drayage and intermodal professionals can help to prevent delays in your supply chain.

ITS has dedicated teams of drayage and fulfillment professionals that are staffed around the clock. Whether you are looking for a third-party logistics provider to help you transition your current operations to omnichannel distribution, or you just want a provider who can efficiently and effectively help you manage your current operations, ITS has a solution for you.

Learn more about distribution services.

Learn more about drayage and intermodal services.