A picture of the impact of supply chain on inflation

The inflation picture in the US peaked in June 2022 with living costs rising at a 9.1% rate for the previous 12-month period. While inflation has been improving since that point, supply chain shortfalls have yet to fully run their course. Inflation’s surge began in early 2021, when disruptions and a shortage of commodities were at an all-time high. The imbalance in supply and demand has forced prices higher for consumers and supply chain leaders alike.

The restricted supply of goods throughout the pandemic came at the same time as a strong demand for many of those same goods. This in combination with trade restrictions, factory closures, rising freight rates, and a previous reliance on just-in-time inventory systems led to global shortages and pushed up inflation. The prices of food, fuel, and construction materials surged and resulted in vulnerabilities in supply chains across the globe.

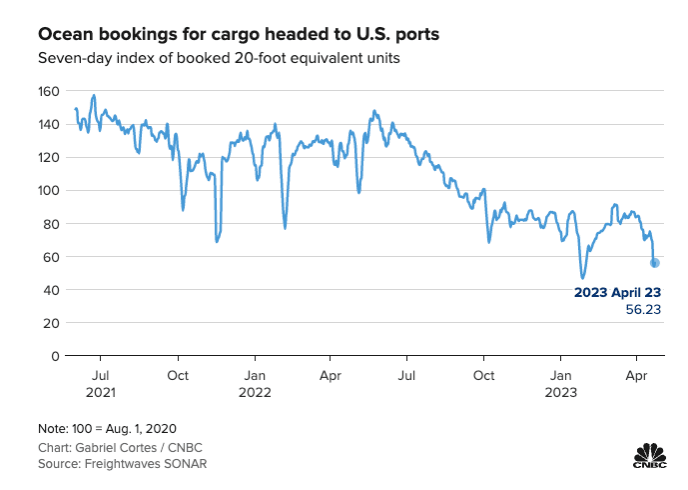

Plummeting freight prices create supply chain shocks

Ocean freight orders are down 50% year-over-year (YOY) and the decline in volume has impacted both rail and road transportation. A freight slowdown in the United States has been clear in the data for months and that shock continues to be reflected in recent months activity. This combined with a 40% decrease in manufacturing orders has a trickle-down effect that results in less freight movement by both truck and rail.

Consumer demand is still focused on experiences like travel, leisure, and eating out; however, with respect to goods, there has been less of a focus of spending on discretionary items and more on the basics. According to a report from DAT Freight & Analysis, the national average spot van and refrigerated truck rates dropped to two-and-a-half year lows in March 2023. These low rates capped a challenging first quarter of the year for most carriers.

Shippers are looking to take advantage of lower prices to stabilize their carrier base and bring contract rates back to pre-pandemic levels. Spot rates are predicted to remain at touch-bottom levels until retailers begin to replenish inventory for end-of-year holiday sales.

Labor shortage across the US

Many organizations are facing higher increases when it comes to labor, which can quickly become one of the largest budget expenses. Worker shortages have been hitting the supply chain industry hard. Several parts of the logistics sector are quite labor intensive, with drivers and warehousing taking up a very notable portion. Training new employees is both time consuming and costly, which puts further cost pressure on organizations.

According to the Supply Chain Stability Index, freight costs combined with labor challenges contribute to 92% of the supply chain stress being felt today. The Index further found that while the US unemployment rate was low at 3.5% in December, that was adding pressure to supply chains and their ability to fulfill orders. The US economy shed around 13.5% of jobs in 2022 according to Bloomberg. In December 2022, there were 11 million job openings, equating to 1.9 job openings for every unemployed person.

While the number of job openings remains high across supply chain functions, they have also stabilized. However, unfilled orders continue to increase as the popularity of ecommerce has grown, which is expected to put additional pressure on labor shortages soon.

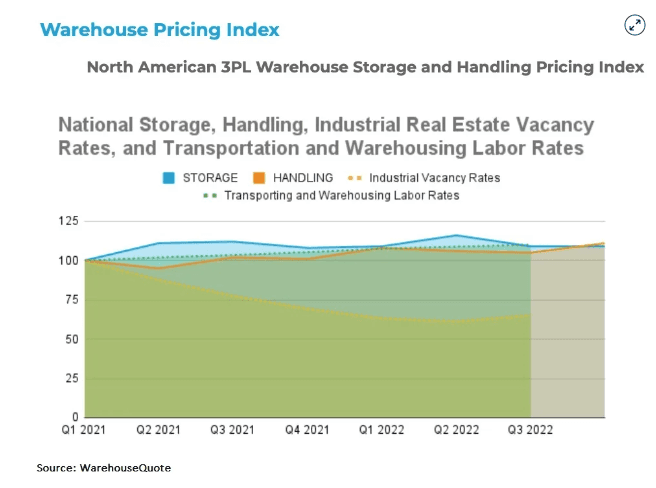

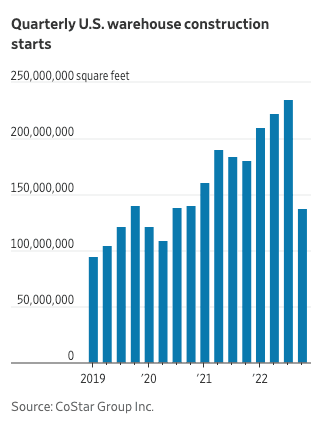

Higher prices across the warehousing sector

While bumpy economic conditions have pushed transportation rates to pre-pandemic lows, warehouse prices have remained high. Warehouses and distribution centers (DC) in the US have risen nearly 11% YOY in February 2023. Experts predict that rates will continue to rise at a more reasonable rate due to economic headwinds.

Vacancy rates have also reached levels unheard of within the last 12 months. The greater Los Angeles market, including the LA seaport basin and Inland Empire, reported a 0.9% vacancy rate in Q4 2022. LA was closely followed by Savannah, Georgia at 1.1% and Reno-Sparks, Nevada at 1.5%. Construction of new warehouses is slowing in 2023 as developers fight rising interest rates, potentially prolonging the constraint on capacity. US industrial construction starts fell 24% in the fourth quarter of 2022 when compared YOY. Developers began building ~137 million square feet of new warehouse space, the lowest amount to start in a quarter since the start of the pandemic.

Some shippers have been holding their products in containers on chassis because of full warehouses and DCs, which also means they are incurring charges which are then passed to the consumer. Containers left on chassis create two problems: preventing the chassis from being used to move arriving containers and being charged container dwell fees. Dwell fees are separate from the per diem charges that shippers pay per day once the container is out of use beyond its free time and they can lead to tens of millions of dollars in penalties.

Overcoming supply chain bottlenecks with ITS Leadership

How can supply chain leaders take proactive steps in the face of inflation to ensure cost savings and retain customer loyalty? We sat down with Sr. Director of Regional Operations, Eric Ashlock, and VP of Client Success, Mitch John, to gain their expert insight.

What actions can logistics leaders to take to be proactive in a challenging economic market?

MJ: “Educating a potential customer on the importance of having a one-stop shop with a trusted and capable 3PL partner can offer a customer multiple services at a discounted rate. 3PLs can also help invest in various assets so their customers don’t have to absorb all of the financial burden when trying to improve efficiencies and reduce overall costs. Building a 3PL network with multiple geographical nodes gives a competitive advantage and allows both current and potential customers the ability to reduce overall shipment costs.”

EA: “We have a current customer who was frustrated with their previous provider’s services. Any time that the customer’s needs would change, and they needed to implement changes to their omnichannel network, the provider would ask the customer how to proceed. The provider should be the one who is providing the expert advice and knows the market up and down. To find the most effective methods, working with a comprehensive team of experienced leaders and associates will take the pressure away from you. Not only can a 3PL provide pre-negotiated parcel rates from partnered providers, but our teams can take your shipment all the way from the port to customer.”

Trusted supply chain management

As business operations grow and the global economy shifts, outsourcing shipping and distribution to a trusted 3PL provider can save time and money. With over 3.7 million square feet across all distribution facilities and a knowledgeable team of distribution, fulfillment, and warehousing experts, ITS can offer a unique nationwide solution that will help grow business operations.

ITS Logistics not only provides comprehensive B2B, D2C, retail and omnichannel distribution services—from drayage services to single small parcel ecommerce delivery to LTL and full truckload distribution. With advanced EDI, API and custom system integrations, expertise in vendor compliance and routing guides, and a hyper focus on customer service, we will help you increase efficiency, build supply chain resilience, and meet evolving customer expectations.

Discover how ITS has helped its customers:

- Caraway Sees 280% Order Volume Increase and Expands into Omnichannel Fulfillment

- Common Challenges, Uncommon Solutions

- ITS Logistics and Starbucks – A Perfect Blend