ITS Logistics August Port Rail Ramp Index: Inbound Volumes Remain Strong as Peak Season Shipments Arrive, Export Volumes Challenged by Latest Tariffs

-- Trucker financial health is an escalating concern as major West Coast drayage providers cease operations. --

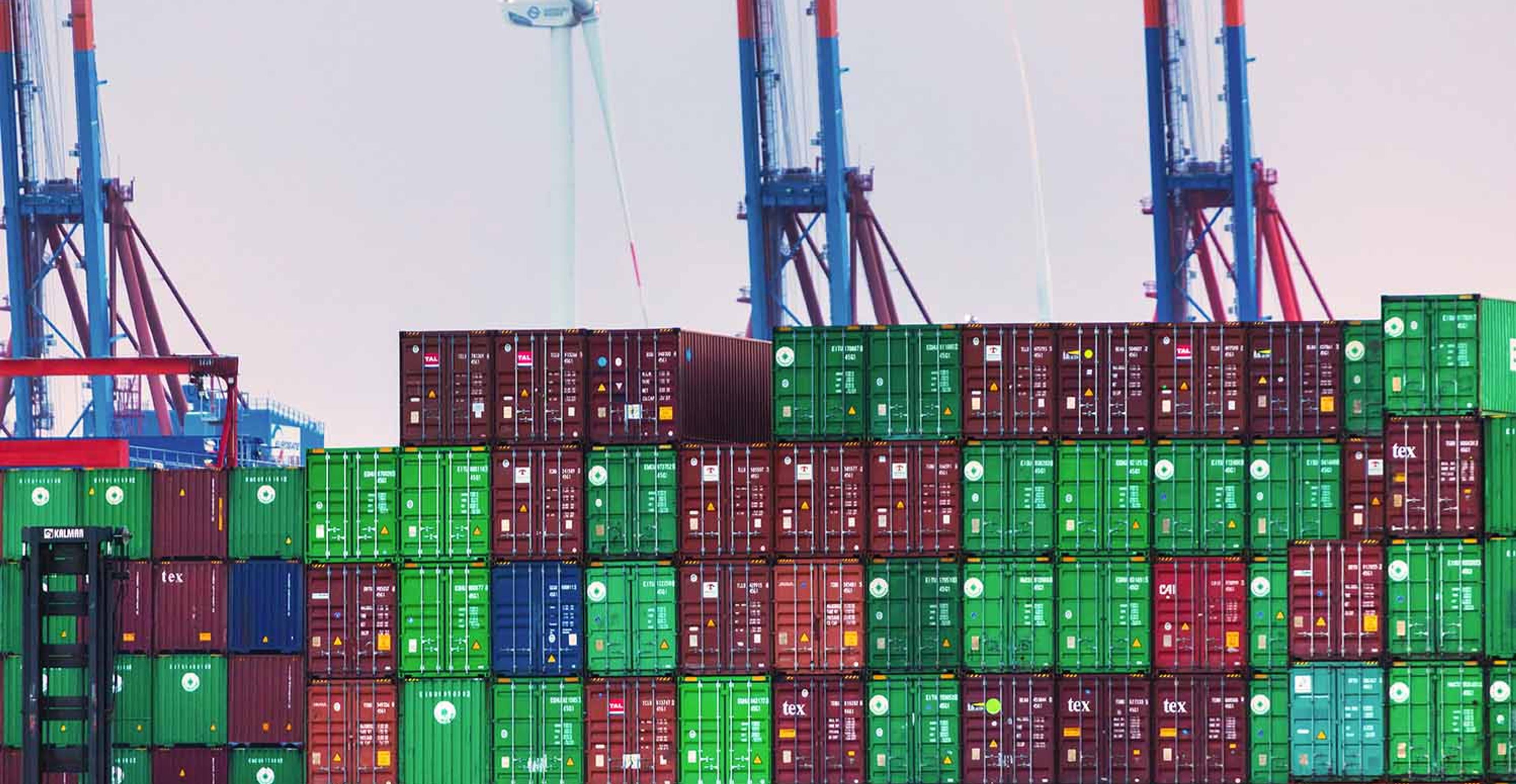

RENO, NEV.: August 14, 2025 – ITS Logistics today released the August forecast for the ITS Logistics US Port/Rail Ramp Freight Index. This month, the index reveals export volumes remain challenged as tariff negotiations continue, while inbound volumes, especially to the US West Coast, are still strong. Trucker financial health is also an escalating concern across the industry.

“As tariff negotiations continue, industry professionals can anticipate surges in export volumes to follow agreements between the US and other countries as shippers work to meet pent-up demand,” said Paul Brashier, Vice President of Global Supply Chain for ITS Logistics. “This should increase freight costs, especially in the spot market. While export volumes continue to be challenged, inbound volumes are still strong as front-loaded goods and retail peak shipments arrive in preparation for the fourth quarter. Day-side congestion at the terminals is also being reported, and empty termination availability is challenging.”

In May 2025, FreightWaves reported that the agreement reached between the US and China to roll back tariffs and implement a 90-day pause for the continuation of negotiations was expected to have immediate effects on global shipping and transportation markets. The matter was creating global economic disruption, and transportation rates were expected to surge as importers rushed to leverage temporary tariff reductions. Both capacity and rate changes were also expected to escalate quickly.

Now, with new tariffs placing pressure on international trade, the National Retail Federation’s (NRF) Global Port Tracker report — released this month — confirmed that import cargo volume at the nation’s major container ports is forecasted to end 2025 at 5.6% below 2024’s volume. Overall, the preliminary data depict just how great an impact both the current administration’s trade policy and existing tariffs are having on the supply chain. Furthermore, tariffs are increasing consumer prices, but due to fewer imports being received, businesses will eventually experience fewer goods on shelves, with small businesses especially struggling to remain open altogether. In July, total retail sales, excluding automobiles and gasoline, were up 1.45% seasonally adjusted month over month and up 5.89% unadjusted year over year in comparison to June, with consumers increasing spending habits in anticipation of future price hikes and potential shortages.

This past June, the Port of Los Angeles handled 892,340 Twenty-Foot Equivalent Units (TEUs) of cargo, which was 8% more than last year, making it the busiest June in the 117-year history of the port. June 2025 loaded imports amounted to 470,459 TEUs (10% more than 2024) and loaded exports landed at 126,144 TEUs (a 3% improvement from 2024). A total of 295,746 empty container units were also processed, a 7% increase over last year.

“Volumes should subside as we approach September, except for infrastructure and project freight,” continued Brashier. “With the newly passed congressional bill, companies should increase those activities through 2025 into 2026.”

Brashier went on to confirm that industry professionals should also pay close attention to the financial health of their trucking partners, citing recent closures of major West Coast drayage providers. Last month, both T.G.S. Logistics and GSC Logistics closed after serving shippers for nearly four decades. The two well-respected companies cited the current state of the market for their decision to end services, and they will be missed by supply chain communities across the nation, especially that of the Port of Oakland.

ITS Logistics offers a full suite of network transportation solutions across North America and distribution and fulfillment services to 95% of the US population within two days. These services include drayage and intermodal in 22 coastal ports and 30 rail ramps, a full suite of asset and asset-lite transportation solutions, omnichannel distribution and fulfillment, LTL, and outbound small parcel.

The ITS Logistics US Port/Rail Ramp Freight Index forecasts port container and dray operations for the Pacific, Atlantic, and Gulf regions. Ocean and domestic container rail ramp operations are also highlighted in the index for both the West Inland and East Inland regions. Visit here for a full, comprehensive copy of the index with expected forecasts for the US port and rail ramps.

About ITS Logistics

ITS Logistics is one of North America's fastest-growing, asset-based modern 3PLs, providing solutions for the industry’s most complicated supply chain challenges. With a people-first culture committed to excellence, the company relentlessly strives to deliver unmatched value through best-in-class service, expertise, and innovation. The ITS Logistics portfolio features North America's #18 asset-lite freight brokerage, a top drayage and intermodal provider, an asset-based dedicated fleet, an innovative cloud-based technology ecosystem, and a nationwide distribution and fulfillment network.