Easing Supply Chain Pressures through Global Port Improvements

Global port improvements bode well for supply chain future

Overall port congestion is down 60% across the country and massive backlogs spurred by the pandemic have eased. November 2022 marked the first time since October 2020 that zero ships were stuck off the coast of California, after reaching an all-time peak of 109 cargo vessels waiting in January 2022. While a lull in volume never seems to last long in the supply chain, the downturn in activity is the perfect time to assess the recent spike in port growth.

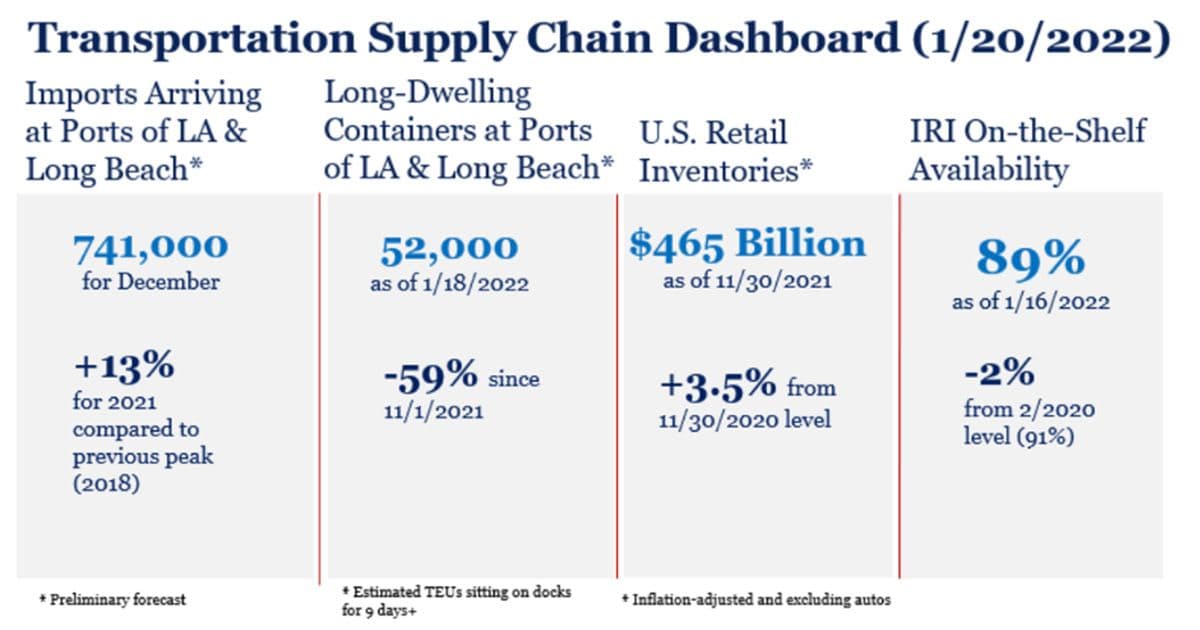

Several US ports handled record numbers of cargo last year and will be undergoing improvements to expand operations. The Ports of Los Angeles and Long Beach moved more goods in 2021 than ever before. As the nation’s largest port complex, LA/LB handles 40% of containerized imports in United States and broke their 2018 record by 13%.

While final year-end numbers are not yet available for the top four container ports in the country (Los Angeles, Long Beach, New York-New Jersey, and Savannah), they are all on track to beat their previous numbers. The four ports moved 18% more containers between January and November 2021 YOY. Smaller ports such as Virginia and Seattle/Tacoma, moved 28% and 21% more containers respectively according to the latest data. To further develop port infrastructure, the U.S. Army Corps of Engineers has committed $4 billion to expand capacity at key ports, allow passage of larger vessels, and enhance the country’s ability to move goods.

Building an inland port in the Mojave Desert

Believe it or not, the answer to relieving pressure at the ports of LA and LB currently lies in the Mojave Desert. A proposed inland complex will soon be a critical relief valve for West Coast gateways struggling with container traffic. The transportation and logistics hub will be developed on about 400 acres of land 90 miles northwest of Los Angeles. The Mojave Inland Port will receive cargo by rail from Los Angeles and Long Beach to be transferred to trucks for further nationwide distribution.

The inland port could save shippers time and money by moving their containers quickly rather than sitting in ship or rail yards for days, and sometimes weeks, waiting to be transported. A decade ago, the average time in port for a container ship was 100 hours, but today it’s over 300 hours. These ships can cost up $200,000 a day, so having the option to take the containers off ship and rail them three hours inland will be a great improvement.

The Mojave Inland Port will offer truck, rail, and air cargo transportation, the site lying adjacent to the fully operational Mojave Air and Space Port. A Union Pacific rail line also runs through the site but plans to build any additional rail lines or infrastructure are yet to be determined. The desert port is scheduled to become fully operational in 2024, with a groundbreaking scheduled for this year.

Additional United States port development

The ports of South Carolina, Georgia, and Alabama were among those that had records years in 2022. The Port of Charleston handled the most containers ever in its history, nearly 2.8-million TEUs in the calendar year. The South Carolina Ports Authority plans to develop the Navy Base Intermodal Facility to provide near-dock rail to Charleston by July 2025.

Partnering with Palmetto Railways, CSX, and Northfolk Southern, SC Ports has planned the new facility one mile from the Leatherman Terminal, with containers moving to and from it on a dedicated road. The containers will be lead on and off trains by rail-mounted gantry cranes and the facility will have a capacity of one million rail lifts. In addition to the new intermodal facility, SC Ports is planning to develop an inner-harbor barge operation to serve the Navy Base. The new marine highway will run between the facility and the Wando Welch and Leatherman terminals, relieving pressure on the port complex’s trucking capacity.

Other investments by SC Ports include:

- $200 million into its SMART chassis pool with 13,000 for the Southeast market

- $2 billion into its container port complex including adding a berth at the Leatherman terminal, modernizing the Wando Welch Terminal to handle three 14,000-TEU vessels at once, and expanding the Inland Port Greer

- Deepening the Charleston Harbor to 52 feet to allow the port to handle mega vessels

A shift to the gulf coast

Despite a recent slowdown in container traffic, many areas are still looking to expand or relocate, like the Appalachian Regional Port in Northwest Georgia. The inland port has a direct rail connection to the port in Savannah and currently runs shipments six days a week. September 2022 was the second busiest month in history for the port and they are seeing the potential for double that volume. They plan to implement more lifts to move containers off the rail line while also expanding the footprint at the facility.

Container inventory is calculated through communication with the Savannah ports in congruence with storage algorithms that track the containers’ location. The terminal currently handles on average 200 gate transactions per day. To further relieve the inland port, the State of Georgia is making additional plans to build another inland port in Hall County, exploring potential locations near Columbus in west Georgia.

The Port of Mobile handled a record 563,191 twenty-foot containers in the 2022 calendar year and reported its busiest month ever in July. The port authority plans to deepen and widen in 2025 to provide access to five Class 1 and four short-line railroads. Over improvements will include a fly-over bridge to create on-dock rail access at the container terminal and developing an inland intermodal facility. Once the project is complete, the port will be the deepest container terminal in the Gulf of Mexico. With immediate access to nearly 15,000 miles of inland waterways, the Port of Mobile is responsible for more than $85 billion of economic impact across the state of Alabama.

Global port investments by worldwide shipping giants

Many port operations around the globe are too deep for land reclamation to be an option, so some are choosing to build upwards. In Dubai’s Jebel Ali Port, containers are stacked eleven high due to each sitting on its own rack. This allows the containers to be plucked out individually, as opposed to the traditional method of shuffling containers to get to the right one.

Dry ports have been a great alternative for those areas where building up is not an option. The International Finance Corporation signed an agreement in 2022 with YCH Group and T&T Group to develop a $300 million inland container depot in Vinh Phuc, northern Vietnam. The Vietnam SuperPort will begin operations in 2024 and be able to provide some relief to a country where exports have risen exponentially.

Logistics investments grew everywhere when the pandemic cause ecommerce to surge. Something to note is the shift of trade eastward; for decades, Asian trade was primarily one-way. In the late 1990s, over 70% of Asian exports by value were going to other parts of the world. Today, nearly 60% of Asia’s exports flow within the region, thanks in part to global trade flows and more complex supply chains.

Navigate seaports and other port facilities with confidence

ITS Logistics, one of the fastest-growing logistics companies in the United States, provides port and rail drayage services in 22 coastal ports and 30 rail ramps throughout North America.

ITS is currently ranked as the #11 Top Intermodal/Drayage Carriers in North America by Transport Topics.