Peak shipping season prospects weaken amidst softened demand

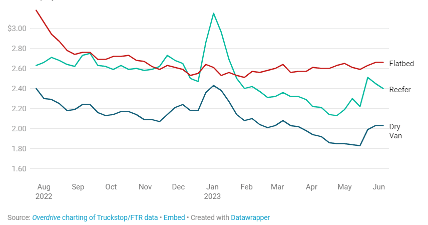

The prospect of a traditional peak shipping season has diminished in the face of low export volumes from Asia. According to major ocean carrier Maersk, demand has remained stable but has yet to see any drastic surge. However, recent sustained rate stabilization has given hope that trucking conditions have bottomed out and a rebound is just around the corner.

Industry experts have been waiting for the freight situation in the United States to improve, with most analysts reporting a decline in April 2023 volumes from the previous month. Year-over-year comparisons also reveal a decline in volume according to data released by DAT Freight and Analytics. The DAT report claimed that dry van and temperature-controlled freight hit their lowest levels in April 2023 since February 2021, when frigid temperature and severe winter weather disrupted movement across the US.

The month of May 2023 has proven to be pivotal for shippers, brokers, and carriers. According to the latest release of ACT’s For-Hire Trucking Index, the cyclical market has rebalanced in preparation for a rebound of business conditions in the coming months. Demand remains soft and while less destocking may have added to freight capacity and an increase in tonnage, economists state that it remains in recession territory. Load-to-truck ratios were down in May, according to the same 2023 report from DAT. When fewer loads are posted for each truck, competition will increase, and this pushes the rates downward.

Freight rates pushed up by operational expenses

Overall carrier operational expenses underwent a drastic increase in 2022, jumping up 21.3%. Fuel was the main driver of the uptick in costs, rising 53.7% from 2021. However, there was much more than diesel and gasoline that contributed to the new highs in 2022. According to the latest annual update form the American Transportation Research Institute (ATRI), operational expenses overall reached a historic $2.251 per mile.

Between the historically high cost of fuel, improved driver pay, surging insurance premiums, and losses from equipment maintenance, turnover, and excessive detention time, fleets have been feeling the cost pressures. Fuel was the largest cost driver–even though prices declined in the second half of 2022, the annual increase was higher than any other marginal cost. However, larger carriers hold a negotiating advantage to secure bulk pricing and achieve lower marginal fuel costs.

Falling fuel prices were a leading contributor to the moderation of inflation in the first half of 2023, according to the ATRI update. It further predicts that continued decline or stabilization in this area could contribute to stabilization in driver wages or other cost factors. Driver wages also rose, 15.5% in 2022 over 2021, reaching 72.4 cents per mile. Fleets have reported that they feel the higher rates are required to attract professional drivers or retain the ones they have.

Will there be increased demand in the back half of the year?

August is when the holiday orders are traditionally imported, and manufacturing orders can be made as much as six months in advance. In Q1 2023, the US consumer was navigating record inflation leading discerning shoppers to pull back on retail discretionary spending. Inflation has begun to cool in the US due to Federal Reserve rate increases, however the fallout from the first half of the year is expected to result in another flattened peak season like 2022.

Cargo carriers sound cautiously optimistic that the world economy will bounce back in the second half of the year. Emirates SkyCargo stated that they have seen a high demand for long-term contracts from key global customers, indicating a steady level of demand for their next six months to a year. Hapag-Lloyd expressed similar confidence and the inevitable return of stronger consumer demand. The container carrier posted volumes in March and April that were improvements to a slow start to 2023.

While the first half of the year has seen muted demand, the arrival of holiday orders and resultant consumer spending remain to be seen. Holiday cargoes are being shipped later than they were in 2022, no longer driven by fears of delivery delays due to port congestion and potential labor unrest. September is traditionally a high-volume month for end-of-year products at the Port of Los Angeles. This is when many toys, games, clothing, footwear, and more arrive for the holiday season.

“Peak shipping season is no guarantee.”

Peak season is not always a guarantee. I have seen many organizations who focus on three months out of the year to hit their revenue goals. Because of the disruptions and fallout from the pandemic, orders are being made sooner and more inventory is being kept on-hand. The supply chain has changed–this could be the new normal for who knows how long. My advice: Adapt operations to focus on the long-term and not bank on a possible peak season to get you through the year. These times are challenging for all of us, but we must stay focused on the root–not the fruit.

Experience excellent customer service with ITS Logistics

Today’s supply chain environment requires balancing logistics operations and multiple competing objectives in the face of substantial uncertainty. At ITS Logistics, we focus on building relationships with our customers. By staying personally connected, we can retain the trust and open communication that is required to successfully navigate the supply chain.

Find out how ITS Logistics helps its customers: