Information and background for this article was contributed by Manny McElroy, ITS Logistics Senior Vice President of Transportation.

With an oversaturation of capacity and underwhelming demand, 2023 wasn’t a banner year for the freight industry. 2024 is bound to bring its fair share of unknowns, market disruptions, and operational pressures.

Here are several key market conditions that the team at ITS Logistics are watching closely as part of its trucking industry forecast for 2024.

Supply, Demand, and the Freight Recession

One question is on everyone’s mind heading into 2024: Will this be the year when the prolonged freight recession finally turns around? It’s really a supply and demand question. In terms of load to truck ratios, there are too many trucks and not enough loads. Either loads need to increase dramatically, or trucks need to decrease dramatically.

What’s going on with loads:

2023 closed out in December with a 44% year-over-year drop in van load-to-truck ratios, per data from DAT. Similarly, December reefer load-to-truck ratios fell 54% year over year. There simply isn't enough freight demand and too many trucks.

Two reasons could be contributing to the drop in loads: shippers are holding out on orders after recovering from excess inventory issues and consumers are taking a more mindful approach to spending due to inflation and debt.

On the consumer side, mindful spending became a main theme in 2023 and will likely continue to be in 2024. Despite inflation, holiday spending in 2023 outpaced the year before; the annual growth of spending continued, but the rate of growth slowed to pre-pandemic levels. Credit card balances also spiked in Q3 of 2023, reaching a record $1.08 trillion according to CNBC.

On the shipper side, excess inventory became a serious problem throughout 2022 and 2023. Retailers worked to destock shelves, and inventory levels began to normalize in Q3 of 2023. However, inventory levels are still an issue for many retailers, which could be leading to re-order hesitation, especially as consumers tighten their spending.

Barring some unforeseen circumstances, these conditions will likely stay the same throughout much of 2024.

What’s going on with trucks:

The initial oversupply of capacity began in 2019 after a buying spree of trucks and trailers followed an economic boom the previous year. Then 2020 came, and a combination of low fuel prices and high rate increases led to unprecedented profits in trucking. Carriers were able to pay down debt and build up rainy day funds. Then the freight recession came, and carriers began exiting the market.

The trucking industry experienced a net loss of 29,000 carriers in 2023 according to data from DAT, and more are likely to follow in 2024. Although carriers are dropping out of the market, the drop is happening at a slower rate than expected. Rainy day funds from the boom of 2020 and relatively low fuel costs are allowing struggling carriers to weather the down market for longer. Paradoxically, everyone in the transportation industry wants less supply and more loads, but no one wants to go out of business.

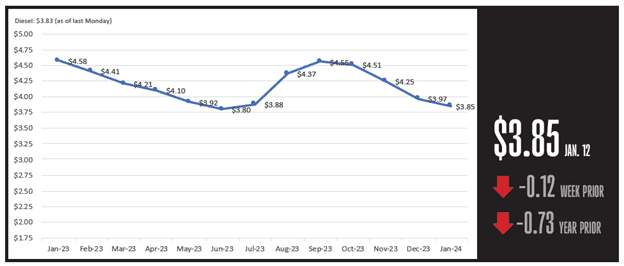

Fuel

In December of 2023, fuel prices were down 15% year over year. Fuel typically takes up 23-30% of carrier operating costs. The cheaper the fuel, the cheaper the overhead, and the better carriers are able to operate on thin margins. This cost is variable and sensitive to geopolitical disruptions, such as conflict in the Middle East, which has the potential to affect fuel costs in 2024.

Rates

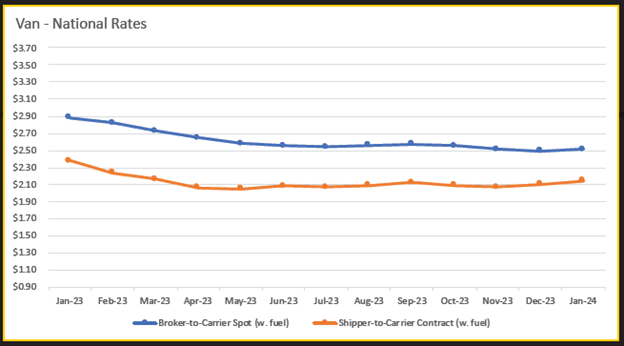

Overall, the market has been soft. Spot rates are up, contract rates are down, and the tender rejection rate rose to 5.2% in late January 2024. The tender rejection rate reflects the willingness of carriers to accept loads; the more willing they are to accept loads, the smaller the tender rejection rate.

Carriers will typically reject load tenders if they lack capacity or think the rate is too low. It’s rare for tender rejection rate to rise above 5.2% outside of peak season. National winter weather events are likely the cause of this most recent rise and not an indicator that the market is tightening up.

Overall, rates are likely to remain flat until the number of carriers leaving the market causes a turning point and shift in supply and demand.

Dry van rates

Dry vans are the most populated in the market, and for the most part, demand for dry van will always remain high. Dry van linehaul rates ended in 2023 at just over $1.75/mile. Since then, spot rates have decreased by $0.03/mi—$0.23/mile lower than last year and $0.05/mile higher than at the start of 2020. DAT’s Top 50 Lanes, which is based on the volume of loads moved, averaged $2.05/mile in early January 2024, maintaining the $0.30/mile spread.

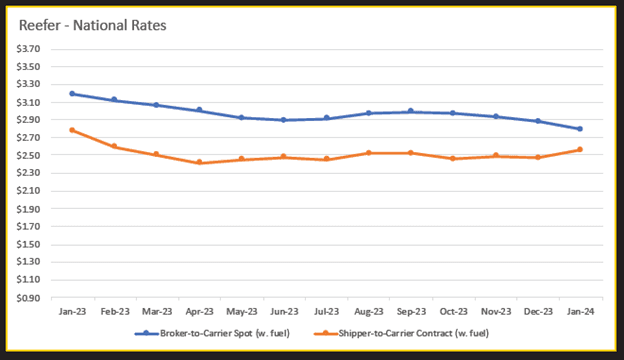

Reefer rates

According to data from DAT, reefer rates dropped $0.10/mile in the first two weeks of 2024. However, winter weather conditions across the US could cause reefer demand to increase as shippers work to keep sensitive goods from freezing in transit.

Transportation & The Economy

There are two prominent downside risks heading into 2024 that could affect transportation: a “stagflationary” environment, featuring an inflation flare up and collapsing economic activity — this risk features prominently in a context where geopolitical tensions remain elevated, fragmentation becomes a reality, and supply shortages become a close memory. The other risk is monetary policy overtightening against a slower growth backdrop where financial conditions would tighten, and private sector activity retrench.

On the upside, non-inflationary growth supported by a robust labor market, consumer resilience, and stronger productivity growth would represent the ideal scenario coming out of this unique pandemic shock. The odds of the US economy entering a recession in the next 12 months are higher than usual, around 45%, but while a slowdown is nearly inevitable, a recession is by no means guaranteed.

There are three key headwinds for the US economy in 2024: cost fatigue whereby the cost of goods, services, inventories, and labor remain much higher than pre-pandemic, eroding spending power; elevated interest rates leading to higher debt servicing costs and rising delinquencies; and slowing job growth dampening consumers’ and businesses’ ability and desire to spend and invest.

At the same time, three tailwinds will simultaneously support activity: the avoidance of a labor market retrenchment still supporting moderate income growth, easing inflation and labor costs compression providing much-needed relief for business leaders and consumers, and the Fed cutting interest rates for the first time since 2020.

The 2024 Shipper Takeaway

Going into 2024, it’s a good time for shippers to evaluate the financial and business health of carriers that were brought on over the 18 to 24 months, especially ones offering lowest rates. Will those same carriers be a good fit if the market turns? And will those carriers be able to maintain their fiscal and business health in the meantime? No one knows for sure if or when the freight market will turn in 2024, but if and when it does, it’s best to be partnered with a fiscally healthy logistics provider that can provide a high level of service.

Get the Most Out of Transportation with ITS Logistics

ITS Logistics has decades of experience providing creative solutions that help customers maximize their supply chain through every economic condition. With the highest level of service, unmatched industry experience and work ethic, and a laser focus on innovation and technology– the team at ITS strives to improve the quality of life for its partners by delivering excellence at every turn.

ITS Logistics maintains a high standard for Network Transportation:

- Strategic built capacity customers can depend on

- Relationship-driven mentality providing 24/7/365 support

- Agile technology that provides enhanced visibility and ensures expert handling of shipments

- 99.2% on-time delivery

- 1,500+ dedicated transportation assets

- #19 nationally-ranked asset-lite provider

Reach out to learn more about ITS Logistics and find a creative logistics solution that will work for your business.