East Coast and Gulf Ports Shoulder Majority of US Containers

Increased container volume at east coast and gulf ports as shippers divert

East coast and gulf ports in the United States are handling much of the nation’s container import and exports as many shippers have been diverting from west coast ports to avoid any labor disruptions. With holiday shopping just around the corner, many retailers are feeling the pressure to get goods on shelves quickly. West coast ports are improving after undergoing months of delays and backlogs due to a long list of supply chain disruptions.

The increase of volume to east coast ports has reaching a significant level, rising about 9% in the first half of the year compared to 2021. Houston, the gulf coast’s leading container port, saw an increase of volume by 22% according to the National Retail Federation. The west coast ports have also seen a decrease in Asian import volume, with 44% now entering the country via east and gulf ports.

Importers were forced to divert a large amount of cargo after to avoid supply chain disruptions due to labor concerns at the Ports of Los Angeles and Long Beach. That comes on the heels of at one point in 2021, more than 100 ships were lined up a berth, leading to delays of two weeks or more for many stores. Firms have looked to shifting east to bypass the west coast port bottlenecks.

Current United States port congestion

Containerized goods are still entering the United States at a record pace, with port throughput in August at just under all-time highs. The pileup of waiting vessels off east and gulf ports is extremely elevated. As of mid-September, there were 144 container vessels waiting off North American ports with 37 off Savannah, 25 off New York/New Jersey, and 24 off Houston. Of the total ships waiting, 70% were off east or gulf coasts. With the increase of containers, the warehousing sector on the east coast has seen an uptick in prices increasing 8% since January.

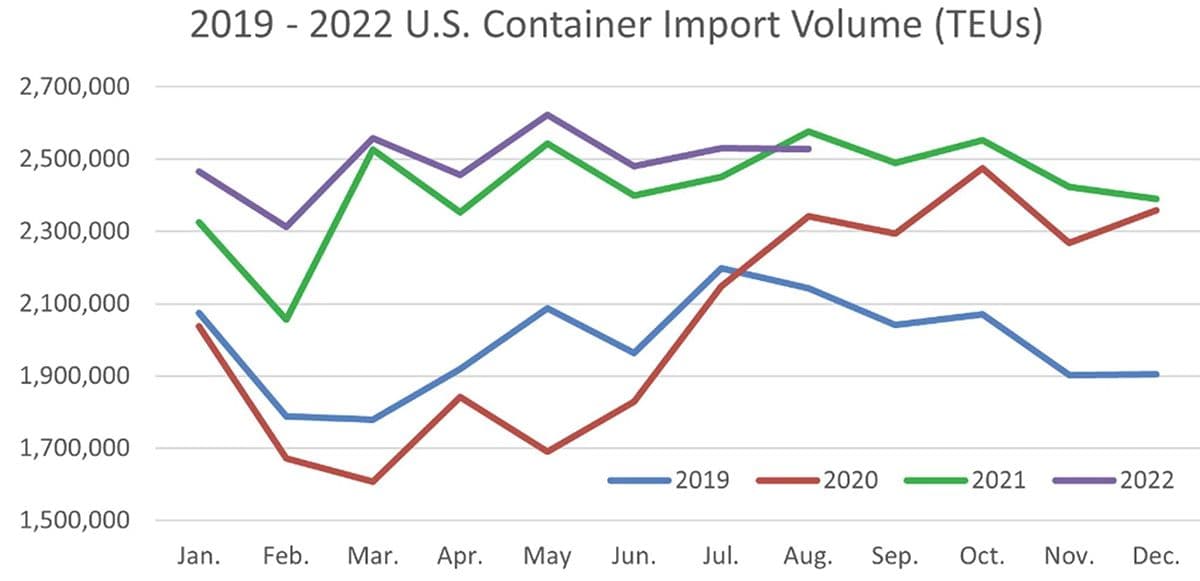

United States monthly import volumes of 2.4 million TEUs or more have exacerbated port congestion, according to Descartes. August throughput numbers were still quite high and above the level that has caused port congestion and delays for the last 18 months. The current port situation continues to point to a challenging global supply chain for the rest of 2022.

More complications for east coast ports are anticipated as a result of the strike at Felixstowe. US imports may be hit once the backlogs start to get sorted out, which could put some holiday goods on shelves closer to the start of the holiday season. The port congestion has ocean carriers modifying vessel schedules and has also been impacting the arrivals of vessels back to Port of Shenzen for reloading.

China trade route and European strikes

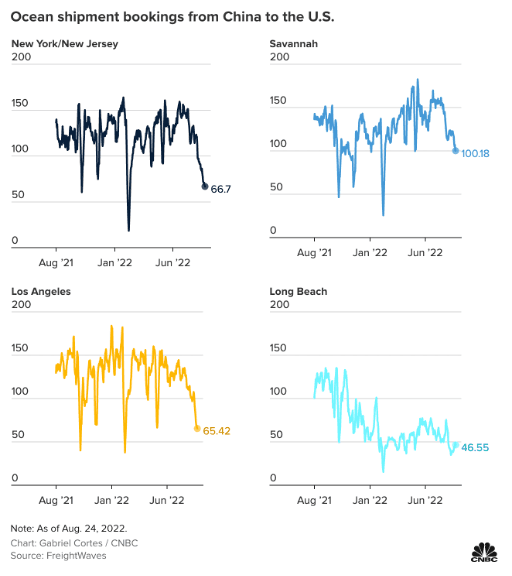

Ocean booking levels from China to major west and east coast ports are nowhere near their two-year highs according to analysts at FreightWaves. With high congestion at U.S. and Canada ports, ocean carriers have been canceling sailings to regain some sort of schedule reliability. All the blanked vessels will be out of position for return voyages, moving containers, loading US exports, and being able to load imports. A pullback in manufacturing has also affected bookings, due to high temperatures sweeping across China and power rationing.

Peak season demand on the ocean looks muted compared to years previous. With softer on demand on ocean shipping, carriers are issuing blank sailings to slow the rapid decline in Trans-Pacific spot rates. Space is currently open for all lanes and ocean carriers are pushing for more bookings with freight adjustment weekly and some daily. This presents a sharp contrast from even a couple of months ago when space was in extreme shortage. Latest freight rates show that China to the west coast is down 6% while China to the east coast is down 3%.

Routes from Europe to North America and China to Europe are both up because of massive port congestion due to labor strife in both Germany and Felixstowe. The German ports have made a deal with the labor union, but it will take until Q1 of 2023 for congestion to clear. The current strike at Felixstowe is slowing down $4.7 billion in trade. CNBC reports that it will take at least two months for the backup of containers to be cleared out. Should the strike continue for the full eight days or longer, the UK can expect to see massive delays with spillover effects into the EU as containers are diverted.

East coast equipment and empty container shortage

As shippers diverted freight east, congestion moved with it. The flood of imports has left port docks and truck yards with an excessive number of empty containers. The current situation has made it difficult for trucks to get in and out of the ports. When empty containers can’t be returned, companies and customers could be on the hook for high demurrage fees from ocean carriers. Empty containers also linger on chassis, which takes the high-demand equipment out of service. Drivers are currently being sent home early due to the lack of chassis.

Due to the high number of empties piling up at the Port Authority of New York and New Jersey, the terminals plan to start charging carriers a container dwell like that at the ports of Los Angeles and Long Beach. The Port of New Jersey has had a container imbalance of over 200,000 since January. Right now, empty containers are sitting at the port for around 30 days. The problem is affecting both coasts, with 87,000 empty containers lingering at the southern California ports.

The implementation of the fee has been delayed following conversations with ocean carriers. The crisis continues to worsen, as polls report that there are no available appointments to return empties. Port officials have told CNBC that the goal is to have the fee in place in Q4 of this year with the first invoices to be issued in January. The rows of empty containers take up important land capacity at the port and restrict trade fluidity.

Additional United States transportation opportunities

Rail-bound cargo at the Port of Los Angeles is waiting about 8 days on the docks compared to about three-days pre-pandemic. The ongoing rail congestion on the west has created an opportunity for east coast ports, container shippers, and rail operators to enter new trade relationships. In January, Hapag Lloyd, Norfolk Southern, the Port of Virginia, and Union Pacific created a triangle of trade for west coast bound freight to be loaded onto Norfolk Southern rail cars from the Port of Virginia. The service also moves containers west to east, along with redirecting containers down to the gulf ports.

Rail delays have not improved on the west coast. Logistics managers have measured rail delays of 12 days at the Ports of Los Angeles and Long Beach. When containers need to be moved by both truck and rail, delays have ticked up to 30 days. The rail congestion at the ports is also causing delays for inland rails. The wait for a container pickup at a rail yard in Dallas has been reported at a shocking 40 – 50 days. Railyards in Kansas City and Memphis are also stacked with containers. The congestion is expected to spur more cross-country trade routes.

As we work with our customers in today’s environment, many are requesting containers to be pulled from rail ramps. The containers are then transloaded and trucked further inland to minimize delays.

Managing drayage and distribution with a trusted logistics partner

By looking down the supply chain, there are strategies to avoid or minimize the impact from disruptions. With a footprint of 33 markets in North America, ITS offers the flexibility to be your sole source of drayage options despite changes within the supply chain. Our team can execute creative solutions from port to door.